Open a Savings Account Today

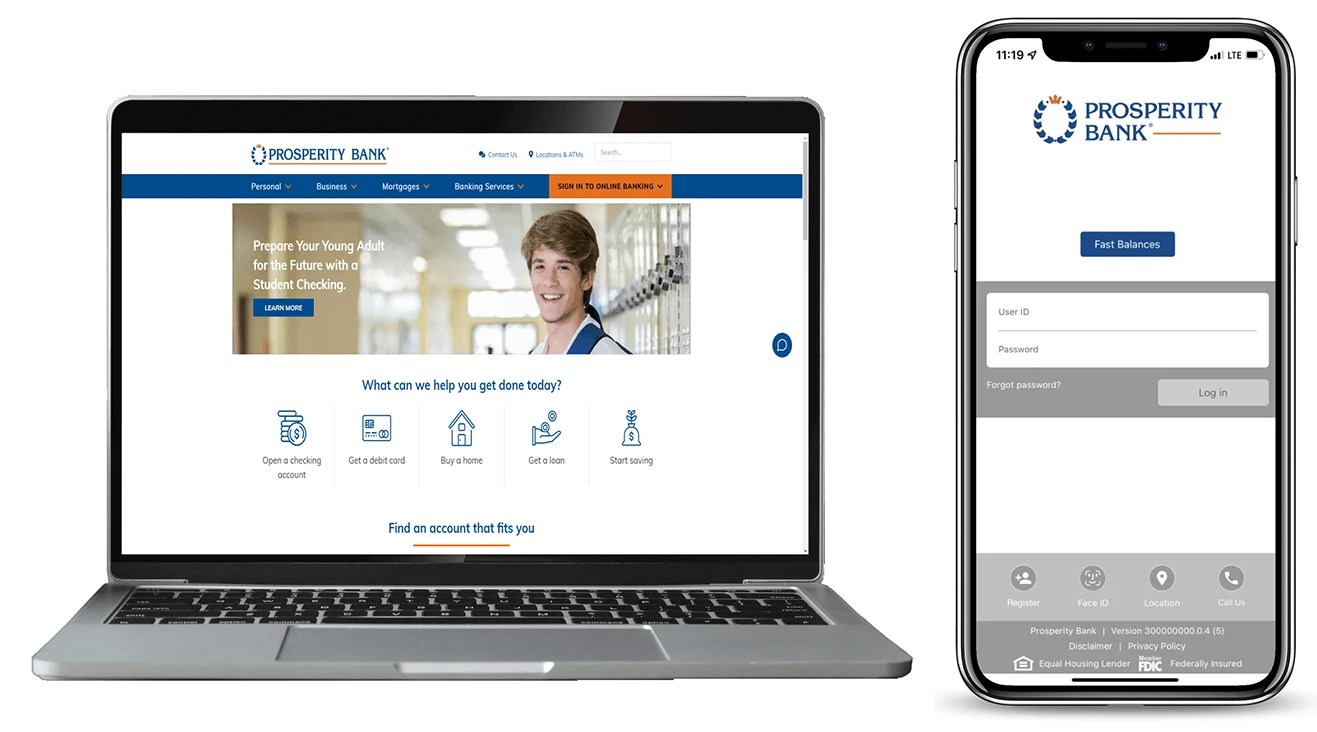

Open a savings account at your convenience directly from your computer or mobile device.

Savings Accounts for Your Everyday Banking Needs

Enjoy all the great benefits that come with a Prosperity Bank Savings Account and elevate your banking experience today. It all starts by clicking the button below and opening an account directly from your computer or mobile device.

Opening an account with Prosperity Bank will provide access to many convenient banking features, including:

- Deposit checks from your mobile device

- Send money quickly to friends and family

- Check balances and eStatements on the go

- Manage your finances

- Pay for purchases with a digital wallet.

Personal Savings

Earn interest and keep your money accessible with this classic account.

OTHER PERSONAL SAVINGS FEATURES INCLUDE:

- $200 to Open

- Free Online Banking

- Free Mobile Banking

- No fees for withdrawals at Prosperity ATMs

- Avoid the $3 monthly maintenance fee by maintaining a minimum balance of $200

- Up to 3 debit transactions per month free (an item fee of $2 for each debit transaction in excess of 3 per month applies)

- Bill Pay – not available**

Personal Premier Money Market

With the Personal Premier Money Market account, you can expect more & get more.

OTHER PERSONAL PREMIER MONEY MARKET FEATURES INCLUDE:

- $25,000 to Open

- Receive a competitive interest rate on your deposits

- Free Online Banking

- Free Mobile Banking

- Avoid a $20 monthly maintenance fee by maintaining a minimum balance of $10,000**

- Up to 6 debit transactions per statement cycle (an item fee of $15 for each debit transaction in excess of 6 per statement cycle)

- Imaged Check Statements available

- Bill Pay not available***

Personal Money Market

A Personal Money Market account is for those who want more.

OTHER PERSONAL MONEY MARKET FEATURES INCLUDE:

- $2,500 to Open

- Receive a competitive interest rate on your deposits

- Free Online Banking

- Free Mobile Banking

- Avoid a $10 monthly maintenance fee by maintaining the minimum balance of $2,500**

- Up to 6 debit transactions per statement cycle (an item fee of $15 for each debit transaction in excess of 6 per statement cycle)

- Imaged Check Statements available

- Bill Pay not available***

Experience the Benefits of a Savings Account

Instant Issue Mastercard® Debit Card

THE CARD THAT IS AVAILABLE FOR YOUR DAILY USAGE

- Contactless payment option – Simply Tap & Pay at participating merchants

- Worldwide Acceptance – Around-the-clock customer service with lost and stolen debit card reporting.

- Fraud monitoring 24/7

Access to Online Banking

BANKING THAT IS THERE FOR YOU WHEN YOU NEED IT

- Free Online & Mobile Banking

- Deposit Checks Online

- Manage Balances

Additional Benefits

- Convenient Banking Centers and ATMs

- eStatements to monitor your accounts on the go

- Overdraft Protection

- Digital Payment Options Available

EXPERIENCE ALL THAT BANKING HAS TO OFFER BY OPENING AN ACCOUNT TODAY

Get started and talk to us

Frequently asked questions

WHO CAN APPLY FOR A SAVINGS ACCOUNT?

Residents of Texas or Oklahoma, age 18 and above are eligible to apply for a checking account. Individuals ages 13 – 17 are eligible to open an account with a parent/guardian as joint on the account.

WHAT WILL I NEED TO APPLY FOR THIS SAVINGS ACCOUNT?

Two forms of valid ID are required: Driver’s License or State Issued ID or Passport. The second form of identification includes: Social Security Card, Birth Certificate, Voter Registration card, a credit or bank card, company ID, passport or Visa. Please contact your local banking center for additional details on forms of identification.

HOW LONG WILL IT TAKE TO OPEN THIS ACCOUNT?

It takes approximately 15-30 minutes to open your account.

CAN I GET A DEBIT CARD WITH MY SAVINGS ACCOUNT?

Yes. A debit card is available with all of our checking accounts. Debit cards are mailed to the account holder.

* Rates and terms are subject to change without notice at Prosperity Bank’s discretion and/or as required or allowed by law.

**Prosperity Bank reserves the right under Positive Pay to require the account holder to transmit certain check issuance information to the Bank regarding checks written before such checks will be paid. Prosperity Bank may return checks presented for payment if such checks are not part of the check issuance information. With Positive Pay, each day checks are written, the Bank’s customer electronically transmits to the Bank a file listing issued checks. When issued checks are presented for payment at the Bank, the checks are compared electronically against the list of transmitted checks. The check issuance information sent to the Bank contains the check number, account number, issue date, and dollar amount, and may include the name of the payee.

More ways to bank with us

Debit Card

Overdraft Protection

Avoid surprise checking account fees

Online Banking

Bank whenever, wherever, and however, you want

FastLine Telephone Banking

Find the number of your nearest banking center

Mobile Deposits

Deposit checks in a ‘snap’ with your smartphone

Online Check Order

Shop and order from a range of checks

eStatements

Receive statements, notices and more online

Apple Pay

Make secure one-touch payments